Over the past few years, I have done quite a bit of testing and experimentation.

Master domain investing in 2024 with our top 16 expert tips!

Boost ROI and secure premium web real estate. Start investing smarter today!

While some learnings are specific to the Squadhelp and Dan platforms, many have broad implications.

16 Domain Investing Tips To Follow In 2024 and Beyond

Here are 16 domain investing pointers that have proven to be effective.

1. Add a BIN price

Domains with BIN prices consistently deliver better sell-through rates than Make Offers.

Adding a Make an Offer option can introduce friction and limit the visibility of domains, especially when buyers search for specific price filters.

Most buyers prefer transparent pricing.

2. Offer Payment Plans

Monthly payment options are highly desirable in the current economy, as startups prioritise cash flow.

If you're not offering payment plans for your domains, chances are you're missing out on potential sales, considering that most platforms provide this feature.

You can use Dan, Squadhelp to offer monthly payment plans. I am doing this for my domain mgsupplement.com where buyers can choose the lease-to-own option and pay $434 per month for 36 months.

3. Stay below the hurdle levels

Price your domains somewhat below hurdle levels if they are too close to them ($5,000, $10,000, etc.).

Budget and credit card limits are common among buyers.

Domains priced higher than those thresholds will become less visible, particularly if buyers apply price filters.

4. Give one option: BIN or Make Offer

If you have set a BIN price, do not add a Make Offer option next to it. I am offering a make-an-offer option to my best AGI domain names list.

Buyers doubt the credibility of the price when they see a Make Offer option next to the BIN price.

5. Don’t Accept Your First Offer

In reference to Make Offer, you should never take the first one that is made. I've rejected my first offer on Lemon Law Domain names.

Accepting the opening offer signals to the buyer that they offered too much.

Raising the price increases your chances of closing the deal, even if it seems unfair.

6. Project Your Domain Cost

Use combination metrics like STR and ASP for monitoring portfolio performance.

For instance, if your STR is 2% and your ASP is $2000, you can see that each domain generates $40 in revenue annually on average.

This can make it easier to project the returns on your portfolio relative to the acquisition costs.

7. Google Alerts

To help ensure that the landers are SEO-optimised if your domain has already been developed in another TLD, that helps.

The majority of businesses set up Google Alerts to monitor their brands.

When your lender page is indexed, buyers using alternate TLDs will likely receive Google Alerts.

8. Focus on SEO

In relation to search engine optimization, companies may find it attractive to upgrade to a.com domain if their current.com landers are not ranking well on Google, particularly if the extensions they are using are not up to par.

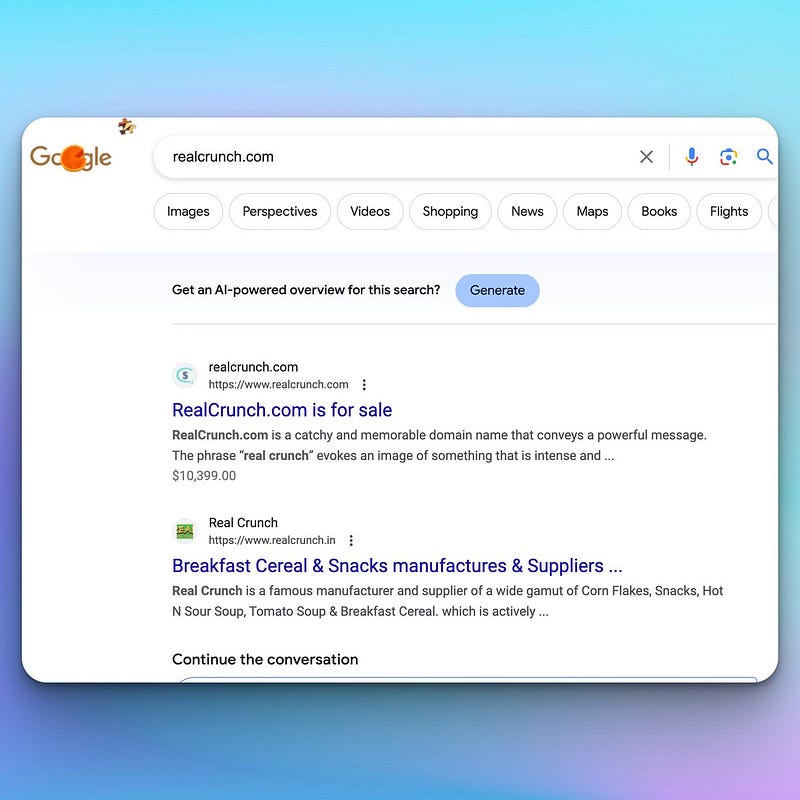

Remember, never target any specific company directly. Realcrunch is a good example which is listed for $10,399 on SquadHelp!

9. Think about VC funding

Give priority to sectors in which venture capital funding is most likely to be obtained when making investments.

For example: Fintech, AI and SaaS domains have more buyers and higher prices than Beauty salons, Clothing brands or Pet store domains.

Check AssistantofAI.com Domain For Sale.

10. Brandable Domain Names

Choosing terms or ideas associated with the industry rather than specific industry terms is preferable for brandable domains.

Example: Words like "Spark," "Love," and "Match" are more likely to resonate with buyers when used as domain names for dating apps than the word "Dating" alone.

11. Think about the Buyer’s mindset

When investing in domains, make sure to step into the buyer’s mindset.

As the CEO of that company, consider which industries might benefit from this domain name and whether you would pick the same name for your own startup.

This helps weed out names that may not be viable for most startups.

For example: The AIO-Writer.com domain name is a perfect choice for companies dealing with AI writing services.

12. Be careful about Trend Investing

In general, trends carry a high risk, but they can also present some short-term opportunities.

While there are a few rare exceptions when it comes to domains with keywords like Meta, GPT, and NFT selling, most of them will never sell.

13. Power of Merchandising

Know the power of merchandising for domains that are brandable.

Although buyers genuinely want unique brands, they typically begin their search with grand concepts or general keywords.

To optimize the exposure, make sure the domains are tagged with the appropriate industries and root words.

14. Manage your base investment

It’s dangerous to base investment decisions solely on individual sales reports.

Remember, a sample size of one is an anecdote, not an insight.

Rather, concentrate on compiled data, your own gut feeling, and the essential branding elements that go into creating a memorable domain name.

15. Choose the best landers

Ensure that your landing page has an SSL-compatible lander that points to https.

It is possible for people to use PHP scripts without adequate testing.

Browsers have not started blocking or showing errors on HTTP pages.

16. Keep Testing

There is no perfect marketplace. You must keep testing your domain investments.

No one-size-fits-all domain strategy exists.

Ultimately, it boils down to determining what works best for your unique portfolio through testing.

So keep testing, and remember to never risk more than what you can afford to lose.